Roof replacement costs are increasing every year, but what if it carries potential tax benefits that many homeowners overlook? In the intersection of home improvement and tax savings, specific criteria can turn certain expenses into tax deductions. Understanding these opportunities requires navigating a maze of federal credits, local incentives, and the qualifying conditions of various roofing materials. So if you’re aksing, “are roof replacements a tax deduction?” this guide is for you.

The landscape of tax deductions related to roof replacement often involves eligibility criteria that homeowners must meet to qualify for benefits. Proper documentation and a clear understanding of qualifying materials or methods, such as energy-efficient upgrades or solar roofing solutions, are crucial. Additionally, distinguishing between federal, state, and local incentives can further maximize one’s tax savings potential.

This article provides a comprehensive guide to making the most of tax deductions when undergoing a roof replacement. From understanding the Energy Efficiency Home Improvement Credit and Solar Investment Tax Credit to consulting with experienced roofing contractors and tax advisors, you’ll gain insight into translating your roofing investment into savvy financial savings.

Roof Replacement and Qualifying for Tax Deductions

When considering roof replacement, understanding its tax implications is important. Roof replacements often qualify as capital improvements, meaning their costs may be depreciated over time rather than deducted in a single year. Generally, standard roof replacements for residential properties do not qualify for direct tax deductions. However, if the roof replacement is for a rental property or a home office, part of the costs might be deductible. Additionally, using energy-efficient roofing materials can open the door to potential tax credits. By selecting certified materials, like ENERGY STAR-rated options, you might reduce your taxable income through federal tax credits aimed at promoting energy efficiency. Always consult a tax advisor to understand the benefits for your specific situation.

General Eligibility Criteria

Roof replacements are usually seen as home improvements rather than necessary repairs, which means they aren’t eligible for direct tax deductions. For tax purposes, the IRS classifies improvements like upgrading roofing materials as investments that increase a property’s value. This classification allows the cost to be added to your home’s cost basis. By increasing the cost basis, homeowners can potentially lower capital gains taxes when selling the property. Still, specific situations, like a dedicated home office or rental properties, might allow some cost deductions. To claim this benefit, you usually need a depreciation schedule. This is particularly true if your roof replacement features energy-efficient materials, which may warrant additional tax benefits.

Documentation and Requirements

Securing a roof replacement tax credit requires careful documentation. The materials used must be certified for energy efficiency, such as those endorsed by ENERGY STAR. These materials help reduce heat gain, which is crucial for qualifying under the Residential Energy Credit. Homeowners can claim this credit by submitting the appropriate IRS form alongside their tax returns. However, it’s important to note that only the cost of materials, not labor, qualifies for the credit. Under the Inflation Reduction Act of 2022, federal income tax credits were extended to incentivize energy-efficient upgrades. Thus, investing in certified roofing materials not only enhances your property’s energy efficiency but may also result in significant tax savings. These benefits underscore the importance of selecting the right roofing materials and maintaining comprehensive records to support your claims.

Energy Efficiency Home Improvement Credit

The Energy Efficiency Home Improvement Credit is a valuable incentive for homeowners to upgrade their homes with energy-efficient features. This federal tax credit specifically rewards those who install energy-saving materials. Homeowners can receive up to a 10% reimbursement on the cost of qualifying roofing materials. However, traditional roofing materials typically don’t qualify. To be eligible, materials must meet energy-efficiency standards, such as being Energy Star certified. Using eligible materials can reduce the taxes homeowners owe, making it a beneficial financial choice.

Eligibility for Roof Replacements

When considering roof replacements, it’s important to know the tax implications. Roof replacements are usually not tax deductible unless they are part of a home office or rental property. Expenses for a roof replacement on these properties might qualify, but not in a single year. Costs are typically spread out over the roof’s useful life using a depreciation schedule. However, if you use certified energy-efficient materials, there may be chances to claim tax credits. Metal or asphalt roofs with energy-efficient features can offer potential tax benefits. To understand the available tax credits fully, consulting a tax professional is advisable.

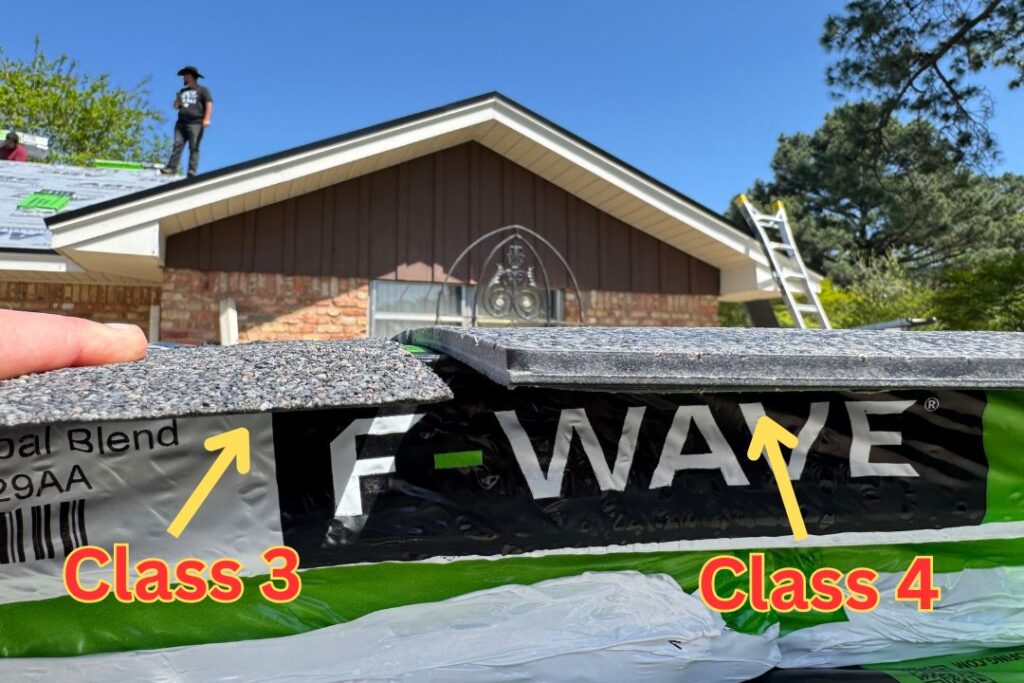

Types of Roofing Materials That Qualify

Choosing the right roofing materials can lead to tax benefits. ENERGY STAR-certified materials like certain metals and cool-asphalt shingles can qualify for credits. Metal roofs with reflective coatings are particularly noted for their energy efficiency. These roofs reflect solar heat, keeping homes cooler. Cool roofs made from specially designed asphalt materials also qualify. They increase energy efficiency by reducing heat absorption. Additionally, solar roofs with tiles or shingles can earn tax credits. These innovations not only lower energy costs but also enhance tax savings, making them wise choices for environmentally-conscious homeowners.

Solar Investment Tax Credit

The Solar Investment Tax Credit (ITC) is a federal incentive designed to make installing solar panel systems more affordable. The credit applies to both residential and commercial properties, offering a reduction in the amount owed in taxes when you set up a solar system. To benefit, the solar panels must be owned, not leased, and you must not sell any generated energy back to utility companies. Ensuring that your solar panels meet governmental requirements is crucial to qualify for this tax benefit.

Using Solar Roofing Solutions

Solar roofing solutions offer a unique path toward sustainable living and can provide financial rewards through special tax credits and benefits. Unlike other roofing materials, solar panels come under separate federal programs that motivate homeowners to increase their property’s energy efficiency. By tapping into federal, state, and local programs, you could maximize these tax credits. However, it’s essential to note that these credits are not the same as direct rebates or loans. Homeowners must ensure they meet specific eligibility criteria when claiming benefits for solar setups, mirroring the process for other energy-efficient improvements.

Financial Benefits and Limitations

Roof replacements are traditionally seen as home improvements and are not usually eligible for a tax deduction by the federal government. Still, installing energy-efficient materials like specific solar roofing can open doors to tax credits, reducing the amount of tax you owe. While immediate tax deductions aren’t an option, you can add roof replacement expenses to your home’s cost basis. This move helps reduce capital gains taxes when you eventually sell your property. Think of this as a long-term investment in your financial future. In emergency situations, a roof replacement might qualify for a casualty loss deduction, but this doesn’t apply to routine upgrades. Meanwhile, using energy-saving materials not only aids in securing potential tax credits but also naturally leads to lowered energy bills over time.

Are Roof Replacements a Tax Deduction? Federal vs. Local

When planning a roof replacement, it’s important to consider both federal and local tax factors. Generally, roof replacements do not qualify for immediate tax deductions at the federal level as they are categorized as home improvements. However, specific energy-efficient roofs may be eligible for federal tax credits. Local and state incentives can also offer savings, especially for energy-efficient upgrades. Knowing these details ensures you explore all potential savings and benefits.

Overview of Federal Tax Benefits

Federal tax laws generally classify roof replacements as home improvements, which aren’t immediately deductible. Instead, the cost is capitalized and depreciated over time, impacting taxable income in the long run. However, the Inflation Reduction Act of 2022 allows some energy-efficient roof materials to qualify for tax credits, potentially reducing your tax liability. These credits differ from deductions, as they directly lower the taxes you owe, not just your taxable income. During ownership, you can’t deduct the cost, but it could reduce capital gains taxes when selling your home later.

State and Local Incentives

State and local governments often have incentives for energy-efficient home projects. Homeowners might get tax credits if their new roof meets certain criteria for energy efficiency. For example, roofs with certified metal or special coatings might qualify. These tax credits can give immediate financial benefits by lowering the taxes you owe, rather than just reducing your taxable income. Additionally, roof replacement costs might be deductible over time through a depreciation schedule, offering gradual tax relief. Checking resources like the IRS website can help guide you on which roofing materials qualify for these credits and incentives.

Are Roof Replacements a Tax Deduction? Consult with Tax Advisors

Navigating the world of roof replacement can be complex, especially when considering tax aspects. A roof replacement may qualify as a capital improvement, which can affect tax deductions. It’s essential to engage with a tax advisor to ensure all angles are covered. A tax advisor can clarify tax rules, ensuring you understand the implications for your taxable income and any possible deductions.

Finding Qualified Professionals

Finding qualified professionals for your roofing project is crucial in ensuring it meets your expectations and financial goals. Collaborating with experienced roofing contractors can help ensure the selection of the right materials, likely leading to energy tax credits. Engaging knowledgeable contractors, like Texas Direct Roofing, assists in understanding and navigating tax laws related to roof repairs and replacements, empowering homeowners to make informed decisions. By hiring dedicated and cost-effective roofing specialists, you can maximize both the practical and financial value of your roofing project.

P.S. are you curious because you’re worried about the cost? Check out why financing may be great for you.