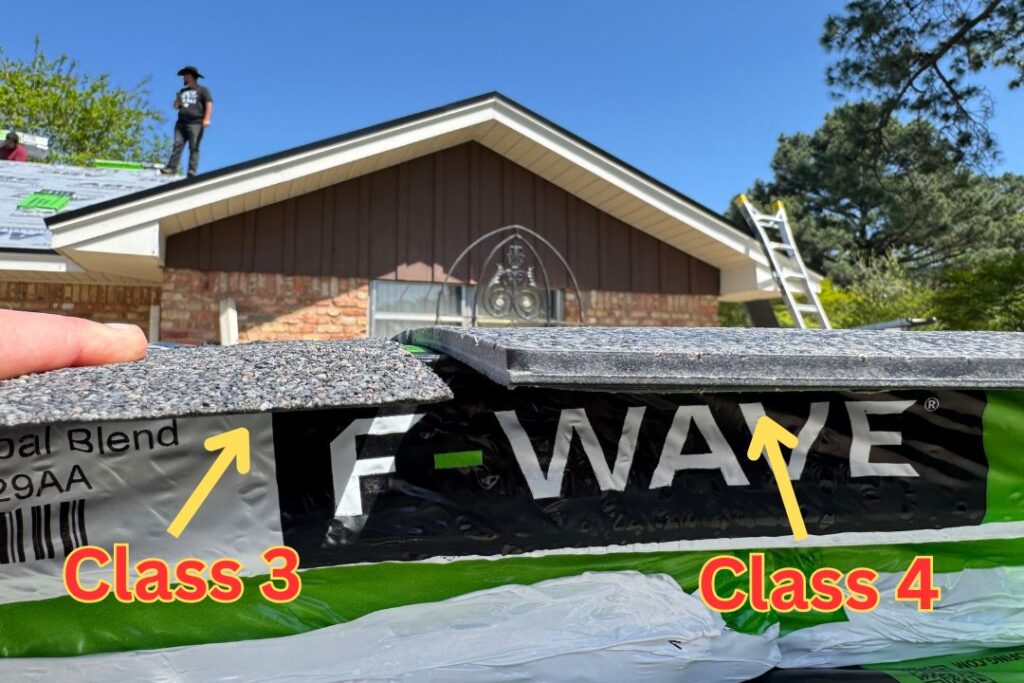

F-Wave shingles are incredible. They are Class 4 hail-rated and Class A fire-rated, and can withstand winds of up to 130 mph. They’re light, and with their big range of designs, they look beautiful on any home. The one downside? They cost quite a bit more than a traditional shingle.

So, when a homeowner is considering upgrading to premium roofing materials like F-Wave synthetic shingles, one of the most common (but least discussed) questions is: Do F-Wave shingles lower your home insurance premiums?

The answer? It might!

🛡️ Why Insurance Companies Care About Your Roof

Your roof is your home’s first line of defense, and your insurance company knows it. Roofs that are more resistant to hail, wind, and fire can drastically reduce the likelihood of claims. That’s why many insurers reward homeowners who invest in more durable roofing systems.

✅ F-Wave Shingles: Impact-Resistant and Class A Fire-Rated

F-Wave shingles are designed to outperform traditional asphalt shingles in nearly every way. They’re:

- Class 4 impact-rated (the highest possible rating)

- Resistant to cracking, splitting, and hail damage

- Class A fire-rated, meaning superior resistance to flame spread

These performance features can make your home less risky to insure—and that risk reduction can translate into premium discounts.

💸 So Will You Actually Get a Discount?

Here’s what you need to know:

- Many major insurers offer discounts for Class 4 impact-resistant roofing, but it’s not automatic. You’ll typically need to provide documentation proving your roof meets this standard. Texas Direct Roofing can supply you with the needed documentation if we install one of these roofs for you.

- Discount amounts vary, but can range from 5% to 30%, depending on your state and provider.

- Some insurers require an inspection or certification after installation to verify the roof qualifies.

📋 Tips to Maximize Your Savings

- Ask your insurer before you install – Call your carrier to find out if they offer a discount for impact-resistant roofing and what proof is required.

- Get a certificate from your roofing contractor showing that your F-Wave shingles are Class 4 impact-rated.

- Keep receipts and warranty info – These documents help verify the materials used.

Do F-Wave Shingles Lower Your Home Insurance Premiums? Final Word

F-Wave shingles are an investment in the long-term durability of your home, and potentially, your wallet. While not all insurance companies offer the same incentives, the roof you choose can impact your premiums. If you’re considering F-Wave, contact your insurer to inquire about any applicable discounts. The savings might surprise you.

Want to look into F-Wave, but worried about the cost? Many of our clients finance the upgrade. Reach out to us to discuss.